Trade EU Carbon Credits

The EU ETS is the world’s largest carbon trade market. The system is a key component of the European Union’s climate policy, which aims to lower net emissions by at least 55% by 2030. The EU ETS was introduced in 2005, and has since inspired the development of trading systems around the world, including the US voluntary carbon market. The system is regulated by the European Commission and the United States Environmental Protection Agency.

A trade carbon credits is a measurement of the amount of CO2 that is removed from the atmosphere, or stored in a greenhouse gas storage device. It can be issued to companies and organizations for the reduction of their emissions. To trade in the EU ETS, a company needs to open an account with an emissions registry, which is a central repository for information on carbon credits. The registry keeps track of the number of allowances held by different users and allows accounts to be transferred between them.

Each EU member state has its own emissions registry. Its security measures vary, but it usually requires identity documents to open an account. The registry also records the date and location of projects, allowing traders to monitor the progress of their projects over time. A carbon credit can be traded in the EU ETS through a variety of players, including retailers, brokers and exchanges. Retailers buy and sell carbon credits on behalf of end buyers. They often take a commission for their services.

How to Trade EU Carbon Credits

Brokers act as intermediaries between retailers and end buyers, coordinating the delivery of a transaction. They may be responsible for ensuring that the transaction is made and advising on the legal and regulatory aspects of the deal.

Another player in carbon markets is standards, which are organizations that certify that a particular type of project meets a certain set of requirements. These can be for nature-based removal (like afforestation or reforestation) or tech-based (like ocean iron fertilization) projects.

The cost of the credit varies depending on the technology, the size of the project and the level of investment required. It can be as low as a few cents per ton of emissions or as high as $15/mtCO2e for afforestation or reforestation projects or $100/mtCO2e for tech-based removal projects such as CCS.

Unlike compliance markets, which are restricted to specific regions, voluntary carbon credits can be traded by companies from all over the world. They are also broader in scope and more flexible, meaning companies can use them to offset their carbon emissions from any source. This is a more cost-effective approach than investing in expensive new technologies and can help companies reach their target. It can also allow firms to be more transparent about their carbon footprint and show investors the impact of their efforts to reduce their carbon emissions.

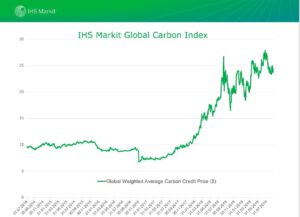

The price of a carbon credit can vary from a few cents to as much as $300/mtCO2e, but this price can fluctuate significantly over time. This is because the price of carbon credits is influenced by the supply and demand of different types of credits.